Get your refund, fast. Plus, track your returns in one place and shop again with confidence.

Less time waiting for your money.

More time shopping the things you love.

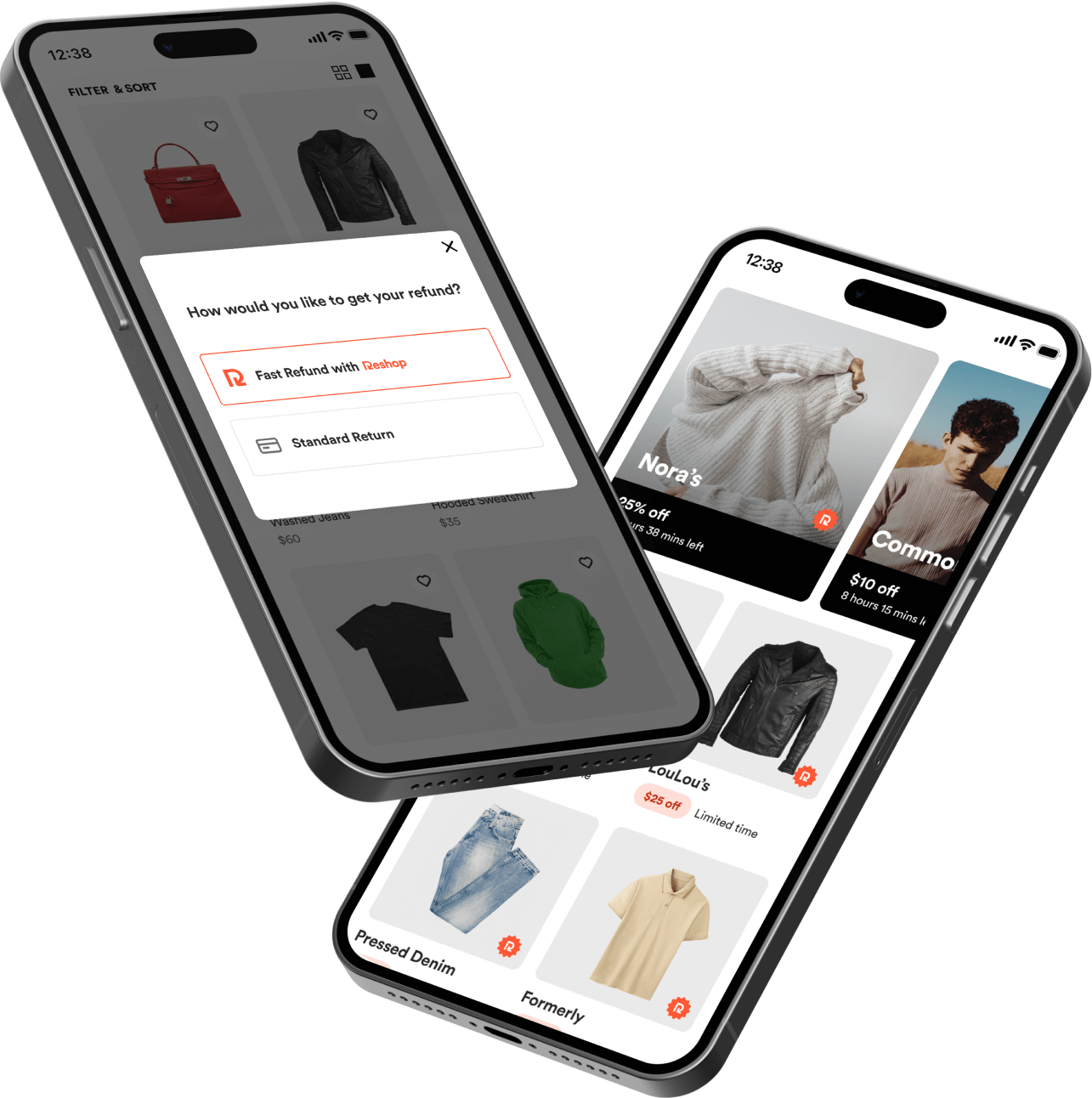

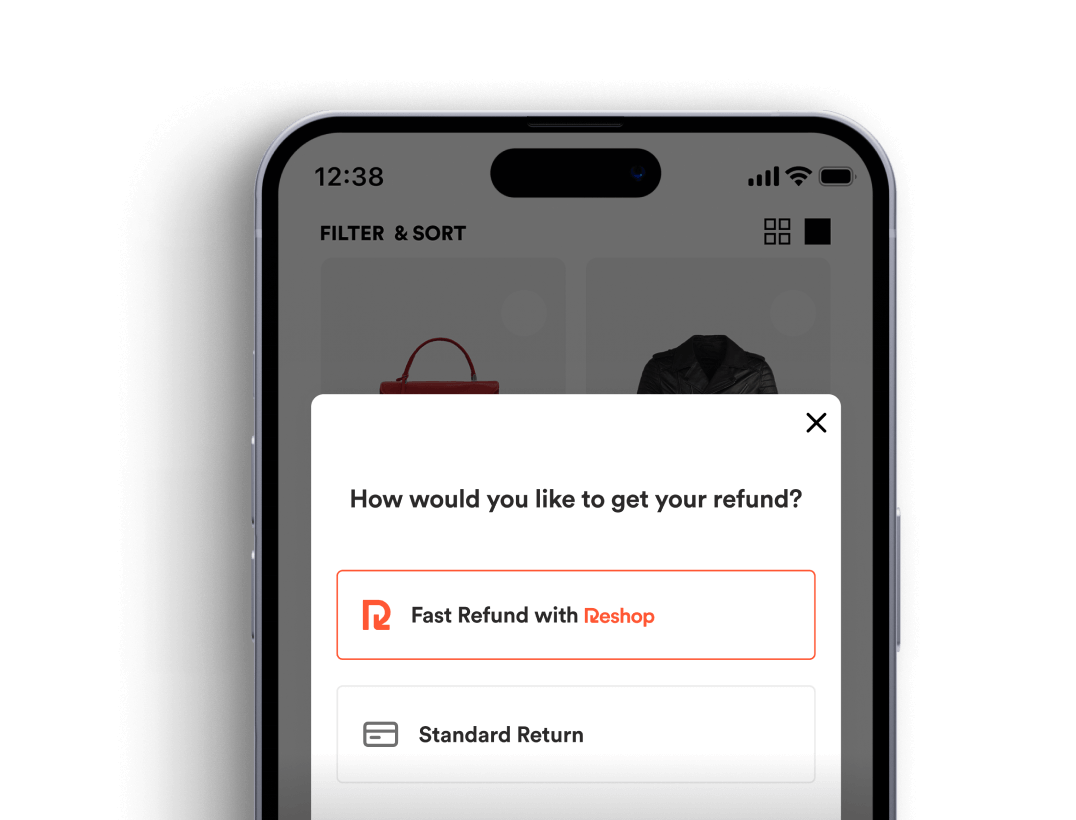

Rather than waiting days or weeks for your refund after you make a return, you’ll get your money back quickly with Reshop. Just select Reshop when making a return and finish getting your money in our app.

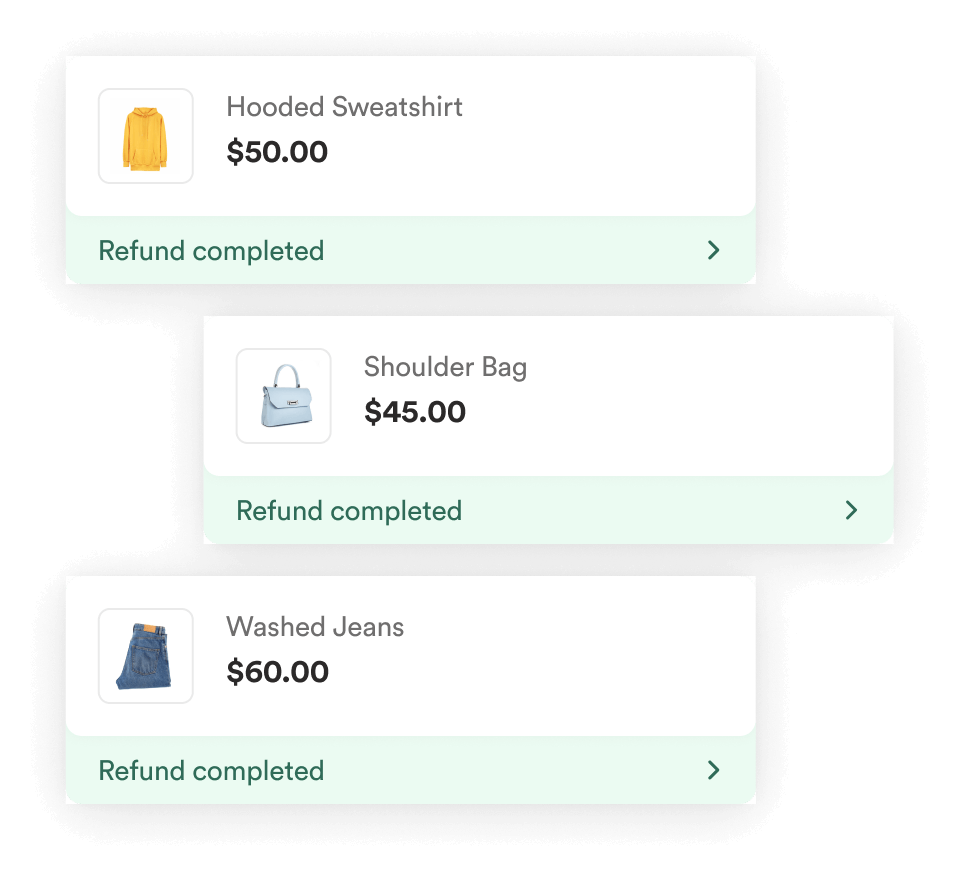

The Reshop app helps you track your returns and refunds in one convenient place. Easily monitor the status of your returns and stay informed about your refund, so you always know exactly where your money is.

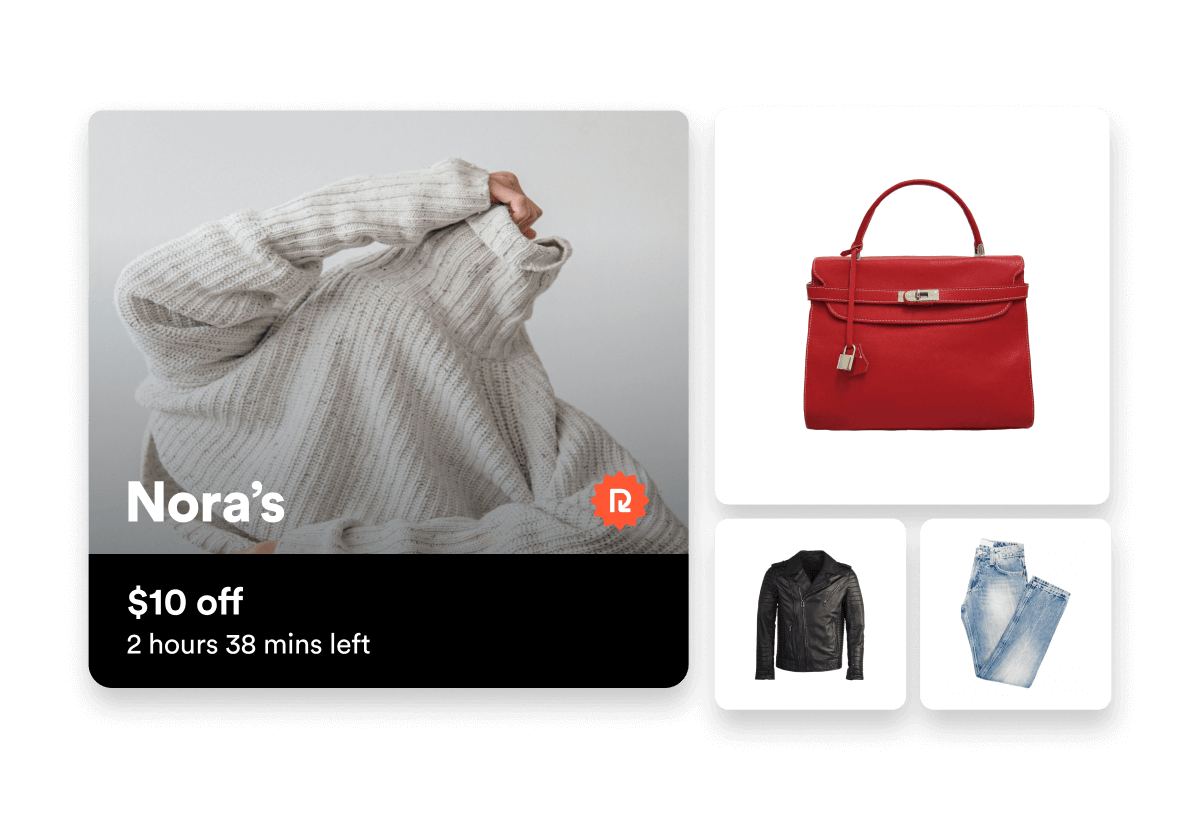

Once you’re refunded, you’ll be able to spend your money right away – and anywhere you’d like. Plus, in the Reshop app, we’ll show tailored products, brands and offers to help you find something else you love.

Here are some common questions. If you can’t find what you’re looking for, check out our Help Center.

How does Reshop work?

Start a return and choose Reshop: Initiate a return with one of our partner retailers, and choose to get a fast refund with Reshop.

Get your refund quickly in the Reshop app: After submitting your return, download or open the Reshop app to finish getting your money. If approved, you can choose to get your refund on a virtual Reshop Card or deposited into your bank account.

It’s your money, spend it anywhere: With your money back in your pocket, you’re free to spend it right away, and anywhere you choose! You can view your Reshop Card details in the Reshop app and use it to shop online anywhere Visa debit cards are accepted. Plus, in the Reshop app, we’ll show tailored products, brands and offers to help you find something else you love.

Ship back your items: You will need to ship back your items within 7 days. We'll provide convenient access to your shipping details and send you reminders to help ensure a smooth process.

How will I get my money?

When you choose to get a refund with Reshop, you will be able to get your money on a Reshop Card or to your nominated bank account. Either way, you’ll have the freedom to use your money however you choose to find the things you love.

How long does it take to get my refund?

If you select to get your refund on a Reshop Card, it will be available in near real time. If you select to get your refund to your bank, it should appear in your bank account within 1 business day.

What is the Reshop Card?

The Reshop Card is a virtual Visa debit card, which is available in the Reshop app and can be used anywhere Visa debit cards are accepted online. When you get your refund on a Reshop Card, it’s available in near real time.

Where can I get a faster refund with Reshop?

Reshop is available in the US at select retailers. When it’s offered, you’ll see an option to select “Get my refund fast with Reshop” when making your return on the retailer’s site. If your favorite retailer doesn’t have Reshop yet, suggest a retailer below and we’ll let them know!

Want to receive faster refunds from your favorite brand? Suggest a retailer you wish offered Reshop, and we’ll let them know!

Reshop Visa Prepaid Card is valid only in the U.S. Limited Use. The Reshop Card is issued by Pathward® N.A., Member FDIC, pursuant to a license from Visa® U.S.A Inc. The Reshop Card is powered by Marqeta. The card can be used anywhere Visa debit cards are accepted. No cash access.